I had an interesting conversation with a potential customer this week who also uses one of the other lead-gen systems.

I had told him: "Plan on $10-$20 cost per lead ($15 average) so that you have a realistic and “flexible” budget to ensure you can target various markets.

This way, you can do the math and at 1-3% (average 2% for most folks) it means your cost per closed deal should be around $750 ($15 CPL x 50 leads)

He’s signing up, because who doesn’t want to put in $750 and get $7,500 out right?

But he did call me back and say, I just can’t stop thinking about my CPL with my other vendor (a well-known vendor who sells on a value proposition “lower cost per lead than the rest of the market”

I really like this topic, because it opens up a great discussion (and something for everyone to think about) and that is the value of “time” and more specifically earnings per unit of time spent.

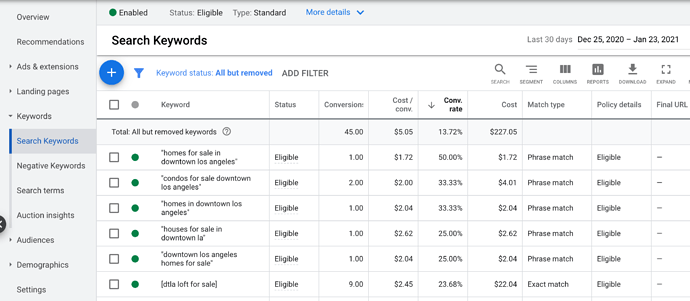

I’ll use real numbers from one of my own PPC campaigns to demonstrate the argument:

“I can get cheaper leads!”

We can do that too! (In fact, we often do, see the screenshot below) but we need to dig deeper into this.

And let’s REALLY think about it (from the perspective of the actual market)

So what do we know about downtown LA?

- The average sale price is $562k (not bad for many markets, but not good at all for LA)

- Home sales in the downtown core are actually dropping due to COVID and people wanting to leave condos and populated cities, in fact, it’s getting harder and harder to sell or even rent condos and that likely is not going to change for quite a while.

- Prices are falling, YOY we’re down 12%

- California is getting hit pretty hard in the press for laws and taxation practices (“everyone is leaving”)

So while there are plenty of leads to buy, and we can get them for quite cheap, selling downtown LA condos can be argued as a bit of an uphill battle. We’ll get a lot of buyers, but they will take their time, see what the market is doing, always want to negotiate a deal while sellers are still trying to hold onto old prices.

So it’s an “ok lead” but certainly not a premium lead.

My estimate is you have to deal with “at least” 5 buyers to close a deal in the next 90 days (some will close later), and those buyers are probably going to take 5 days of your time each (so 25 of your 90 days)

An estimate on cheque size in the downtown market is $15k. So if you spend 25 days to make $15k your rate per day is $600

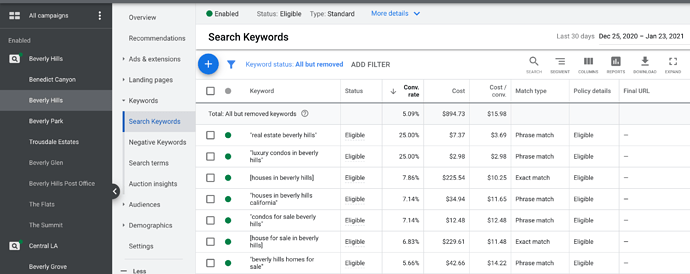

Now let’s talk about the polar opposite: The ultra-luxury, Beverly hills market.

Luxury homes (single-family, away from the city) are at an all-time premium.

In this market:

- Median home sale price is $4.8M

- Average home on market less than 100 days (pretty good for luxury)

- People who do want to live in LA, want “homes” not “Condos” and are willing to pay a premium

- The rich are getting richer (let’s be honest, COVID was a boon for many wealthy people

Now, because it’s Beverly Hills, there is the lookie lou factor: meaning a lot of folks want to just see what a $10M home looks like. Because of this, the conversion rates are far lower on this kind of market, I’d say between .5% and 1% (so call it .75%)

That means you need 133 leads to close a deal.

And of course, because of the price point, competition and desirability of the area, the leads are far more expensive (3 times as much in this case) here are our actual costs for the last 30 days on a sample campaign: Almost $16 CPL

So when you calculate the CPA (cost per acquisition or deal) $16 x 133 = $2,218

That’s a whole lot higher than the cost of downtown LA.

But if you can get a verified buyer in Beverly Hills, they are going to buy!

- Inventory is tight, and they are serious

- Estimated commissions on an average home are over $100k

- You’ll spend less time with them due to the urgency factor and limited supply

I would estimate 1 in 3 buyers who are verified will transact in the next 90 days, and if you spend the same 5 days with them, you are now down to 15 of your days spent with the buyers and a commission cheque of $120,000

Your rate per day is now $24,000 per day

I know, I know, the conclusion is obvious: But let’s state it anyway.

It is far better to get paid $24,000 per day that $600 per day (but for many both are good)

So when you’re looking at purely cost per lead, you’re missing the point.

REW helps our customers decide what they want to sell, and where they want to sell it.

Value for time is a simple calculus: I’m interested in making you the most $ (NET) of costs per day. If that means we buy luxury leads at $50 instead of the rental and mobile home leads for $5 just so we can brag on how “cheap” our leads are. You can bet that’s what we’re going to do!

But if you REALLY want the cheap leads (there are reasons to get those too) it’s not a problem ![]()

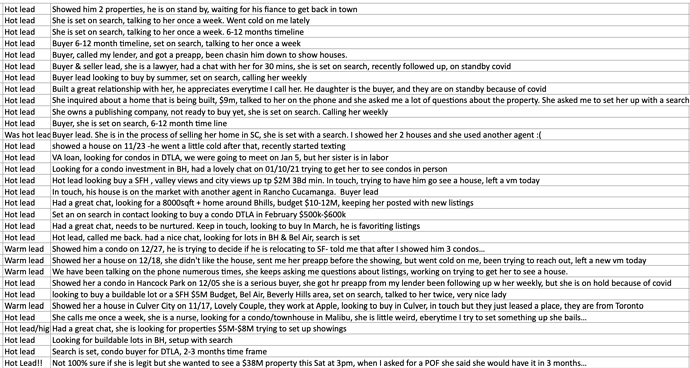

PS, if you’re wondering how this plays out in the “real world” (are any of these leads real?) Of all the leads generated and not closed in the past 90 days from our Los Angeles partners, here is this weeks report: (We spend about $10k on PPC and SEO per month)

Tell me again why you’re not investing in leads this year? ![]()