I have just returned from NAR's iOi conference and my mind is on fire! I am so excited for what is to come, not just for me or for REW, but for our industry. I have been inspired by the amazing entrepreneurs I was fortunate enough to spend time with there, whether it was a brand new prop tech founder with eyes on taking over the world, or more established leaders like Chris Smith of Curaytor who have broken through some massive barriers and come out the other side with some wonderful companies.

For those of you who don't know (which is probably most of you because I had no idea) iOi is the National Association Of Realtors "Innovation, Opportunities & Investment" conference. It was just held in Seattle and I have to say, for tech entrepreneurs & investors (and those looking at getting an edge in tech) it is probably the best conference in the entire industry. (And there are some amazing events).

Seriously, I had no idea! When my head of industry Laura Monroe reached out and said, Morgan this iOi conference is close to us and we have some friends involved, would you be willing to be a speaker and a judge, I was like huh? Who? What is it now? So I took a call from an old colleague Glenn Shimkus (formerly Cartavi & Docusign) he explained what they were trying to do, and who was involved (you know, guys like Bob Goldberg, CEO of NAR and the rockstars from NAR Reach / Second Century Ventures Dave Garland, Mark Birschbach, Tyler Thompson. It sounded fun, and as someone who is seriously looking at the market right now (as an investor and acquirer of prop tech companies for REW, it just made a lot of sense.

I really loved the content, I loved being a speaker, the networking was amazing and the venue was great! But what I really loved was engaging with the entrepreneurs. I got to speak to so many start ups and early stage companies, hear their stories and of course their BHAG’s (Big Hairy Audacious Goals). Let me tell you, there is NO shortage of confidence or enthusiasm in that room. It’s quite exciting.

One thing did stand out to me though (and this is not new, in fact it’s quite common in my dealings with newer or less experienced entrepreneurs) and that is when it comes to building their business and where it might go (the financial, investment, acquisition side of the business) they really had not yet learned how the market works.

And it makes sense! They are busy building their businesses and focused on growth, profitability, scaling etc. They do seem to know that at $100M in SAAS revenue with low churn they can likely get 10x and have a billion dollar business (and that is their BHAG) but what many of them don’t seem to know is that there is a reason for the 10x and that it does not apply to them. And that reason is because it is almost impossible to build a business of that size and scale.

And of course they all hope they are worth 10x today. This is of course not the case.

This was actually the topic of many of my conversations and I WISH that Chris Gough’s presentation on capital markets and M & A was earlier (which in my mind was the best presentation of the whole conference) because it would likely have helped provide some needed context and authority when I was speaking with these founders.

My takeaway on this whole thing is that there is a knowledge gap in our industry in terms of technology valuation, M & A, multiples the whole thing. And while I am by no means a Chris Gough, I feel that our journey has taken us quite a bit further down the path and I’ve been fortunate enough to learn from many experts (much more experienced than I am) about how the investment world looks at your business. I’m going to use our actual numbers (the true story of REW) as context because I think it might help our readers recognize this as less theory and more reality.

To answer all those who are wondering my thoughts on prop tech valuations and how the market looks at our companies, these are my thoughts. They are by no means gospel and any savvy investor or adviser will tell you that private investment is far more of an art than a science. I base this on my observations of the markets over the last 20 years and the hundreds of data points I have personally observed from deals that have both been public, and those that I have private knowledge of the inner workings and financials of those deals. Again I’m no expert so just use this for comparative context to your own business, but now that I’m the “old guy” instead of the “young gun” I do think I’ve picked up a thing or two along the way. Take it for what it’s worth

So what kind of businesses are we talking about here? It’s important to note that different business are valued differently. The residential brokerage business for instance is based on EBITDA multiples (typically between 1-3x EBITDA) whereas pure SAAS business (true SAAS businesses) at scale are 10-15X of top line. It’s a MASSIVE difference. SAAS based tech companies are worth far more than most any other kind of business. Specifically I’m talking about the residential real estate prop tech business which is really the “tech stack” from lead generation to close. So think companies that do lead gen, websites, IDX, CRM, Transaction Management, Accounting and all the things in between. I’m talking companies that are generally well north of 50% SAAS.

So let’s look at the numbers

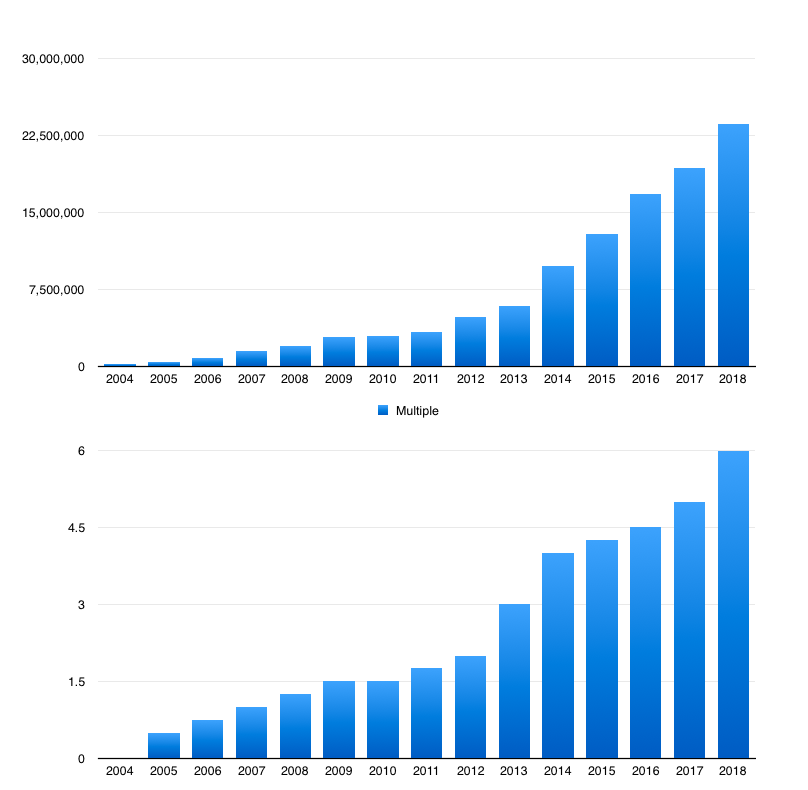

The following graphs shows our example revenue growth over time and the multiples that I believe would be appropriate to assign to our company as a retrospective considering “today’s” investment climate.

Let’s look at some of the moments in time with some commentary. 2004-2007, this new company has growth of 85%, 75% and 84%. Looks pretty awesome right? Who wouldn’t want to invest in this company? Well I wouldn’t, at least not unless I got a ridiculous deal to come in AND if (and this is a HUGE IF) the founder somehow convinced me they had not only a great product but that they were the kind of person who could scale a business long term at some serious numbers. The reality is this, building a business in real estate to $1M-$1.5M is remarkably (relatively) easy. Experienced investors know this.

Flash in a pan, offer market exclusive shiny object type companies do this every year and just a few years later 95% of these companies are gone. I know this because I’ve been doing this for 20 years. investors know this even more. So if you’re in this category, #1 congratulations (because honestly that is still awesome, and worthy of praise) but #2: You need to be honest with yourself, your company is not worth anything. Not even a 1x multiple because the odds are it’s going to fail.

It doesn’t matter that you say you’re awesome (we all think that). It doesn’t matter that you think your product will change the world (we all think that too). It doesn’t matter that you think you’re smarter than all the other guys (I learned the hard way, that attitude actually makes you worth “less” not more). My advice in this stage. Come in humble and ONLY take on a partner or investor if you absolutely have to. Otherwise give it a few years, keep growing, get to the next stage and earn some credibility. Then you can start talking about how you have proved the concept, shown you can run a successful business and that the market values you more than just the next “thing”.

The last comment I’ll make on this early stage is on the comparative value of the investor vs your company. At less than a million or two dollars, if you’re targeting the top of the top investors (those that will not only massively accelerate your company, but also come with contacts and resources that most could never access? Their time (just their time) and the value they bring to the table is actually worth more than your entire company. If they show an interest (and make a commitment) make sure you value and honour their time. Remember, be humble at this stage.

The next gap is the $1-$5M category (Again this is for residential prop tech). This is still a relatively common category although it is far more difficult to get into this category than the first category. It’s probably 10% or less of those companies that get anywhere also get to this category. And those that make it to the higher end of the category? They are rarely seen in residential prop tech. It’s simply too fragmented of a space and very difficult for new companies to come into.

It’s this category that you start getting multiples in (if you’re growing and profitable) but again you need to be realistic, if you spend any amount of time in this category, for that period of time you’re likely a 1-2x multiple. In the sample company above, the company stayed in the 1-2 multiple range for quite some time. Why? It’s growing and it’s profitable, shouldn’t it be worth more? The answer is depends.

Think about it this way, if it’s growing REALLY fast then it will get out of this revenue range quickly (and onto better multiples) but if it’s not, even if you’re quite profitable (let’s say 25%) if you get stuck in this category (which averages 2.5 million) your take home EBITDA is $625,000 and your business is still relatively small (too small for a serious investor to see a return). Often in these businesses just a few lost customers can cause a massive swing in their margins and it is more common to see these businesses fail or lose ground over time than succeed onto the next round. But do the math: You are at $2.5M with $625,000 EBITDA and you could get 2x top line? That’s $5M for a business that’s not very safe, and has not shown it can grow into the future. Put another way, that is like getting paid your entire paycheque for 8 years (EIGHT YEARS) without the risk of losing your business, having to deal with customers, or staff. That would be a pretty exceptional outcome.

So don't get cocky, if you wan a better multiple, get yourself out of this category and onto the next one. You're not worth much here and your opinion or what you read about bigger companies than you getting bigger multiples won't change that.

The next category is the $5-$10M category. This is where you start to see multiples increase. Why? Because it’s REALLY hard to get a business to $5M in SAAS revenue in residential real estate. 10x harder than the 1-5M category which is 10x harder than the category before that. So how we’re at 1000 times harder than just starting a SAAS business and actually making any money.

At this size early stage investors start to take you seriously. They recognize that you “might” be really onto something depending on the numbers (how is your churn, how is your growth, what is your profit and how long does it look like you will stay in this category. Again, you might get stuck here. And if you’re profitable (even at just 5-10%) it’s actually quite a nice place to be. You are making a great living, and hopefully enjoy what you’re doing (you could probably do it for a long time). But let’s remember, multiples are tied to future value and so if you stay here your multiple will be limited.

In our sample company I have this company pegged at 3-4x top line revenue. This is validated by several very public 4x offers once the company reached the $10M mark which you may have seen on Dragons Den. So if you get here, you get to the top of the range quickly and you look like you’re still growing, you can look at 3-4x top line revenue if all of your other numbers are good. That’s 15-40 million dollars. Very few people in their lifetime will ever be able to say they brought a company to that level. If you can get here, you should be VERY proud of yourself. Looking at my list of companies that I follow, I cannot think of more than 10 companies in this category right now. It’s pretty rare

Following the $5-$10M category is the $10-$20M category. As you can see the bands are starting to get bigger as once you hit scale investors are going to hope to see you leverage an experienced management team, have well honed systems, be cross selling into your customer base, price optimizing and doing lots of other things that actually drive revenue faster. And how hard is this again? Each rung in the ladder is 10x as hard. It is 10,000 times harder to get a business to $10-$20M in ARR (AT LEAST 10,000 harder) than it is to start a business in prop tech that makes $ at all.

Don’t believe me? Name more than 5 business right now that fit into this category. Unless you are watching the space and are an investor with lots of contacts, I’m willing to bet you can’t name 5. Why? Because for even the best companies it’s damned near impossible to get there. A lot companies say they are going to get there, and my answer to them is “that’s awesome, so get there” but until you do (until you actually achieve what you say you can do) no investor is going to believe you. Why? Because everyone says that, and no one ever gets there. You are no different (not to an investor) they have no reason to ever believe that you will. They pay for reality and results, not for how much confidence a founder has in themselves and their abilities.

For the $10-$20M category (with growth, profit and reasonable churn) we have seen from 4-5X top line in terms of purchases. That’s $40-$100M in valuation. It pays to get to this kind of scale and there are actually a reasonable amount of investors and buyout firms that will look at you at this size and depending on your product there may be a few strategics that will value your scale / market penetration and look to pay a premium.

Shall we keep it going? We really don’t have too many categories left to explore. The reason for this is, there has never really been a large number of companies to exceed the previous bands. But let’s do a few more just because. I’m going to put the next band at $20-$40M, growth is probably slowing at this point on a % basis simply because it’s much harder to grow a $40M company by 50% (adding $20M in revenue) than it is to grow a $4M by 50% (adding only $2M in revenue). At this level, again you would be hard pressed to find 5 companies in the space. They are among the largest prop tech vendors out there and most of them (if they exist) have already taken funding or been taken out by strategics or VC’s.

You probably know the names (because these deals hit the news), Boomtown, CINC, Inside Real Estate, Lone Wolf, Market Leader (the first time), Dot Loop . They all got taken out in or around this range. By taken out, I mean their founders got some great news as they received offers from multiple suitors and each of them sold the majority of their shares to some big investment company for a huge amount of money and their early investors and owners did very well. And they SHOULD HAVE! They worked their asses off and did the near impossible. They got their companies to an unheard of scale and were at the point where they could be a strategic play for some companies or a central platform to build around for roll up or tuck in acquisitions. Bottom line we’re in the VC buy box now You’re almost a unicorn). These deals are rarely publicly disclosed, but I would put the multiples on these deals in the 6-10x range (though I heard one of these deals went for a whopping 13x, it’s a rumour and if it’s true that company WAY overpaid.)

The final category (if you miraculously have not been bought out yet) is basically $50M+ ARR. Get here and I think you’re virtually guaranteed an 8-10X+ multiple as long as you can keep the rest of your numbers healthy (low churn, profit, growth etc) and really you should be able to. At scale SAAS businesses become extremely profitable because of the economies of scale. These businesses (which are virtually unheard of in real estate but exist many other places in SAAS categories outside of real estate) drive multiples and profits that are extremely strong, tend to be sticky, and far more protected from erosion. They are category leaders. This category is also my BHAG, I want the unicorn status too! But in the meantime, I know we have to get there for someone to say we are there. It won’t just happen (nor will anyone ever pay like it happened) just because I say we can do it.

This is the central theme of my post: Be realistic with where you are (RIGHT NOW) I’m going to leave you with these final comments

#1: Investors pay for facts not stories

#2: You are worth what your numbers say you are worth TODAY not what you hope your numbers will be tomorrow

#3: You cannot sell anyone on what “might” happen “after” they invest. That growth will have been because of them, not because of you.

#4: If you really could have done it, you would have done it. Stop bullshitting people (and yourself)

#5: If you really can do it, then do it! You’ll get your credit when hit your numbers, not before.

And on a final note: Please remember this is all based on a specific set of circumstances: Growth, Profit, Low Churn. If you have no growth cut the numbers in half or more. If you have no profit, cut the numbers in half again and if you have high churn, cut the numbers by half yet again because churn is the bane of all SAAS business valuation.

I hope this helped. Reach out to me with any question